Learn about the ways Envision Wealth Planning walks alongside clients

Our team of financial advisors at Envision Wealth Planning are passionate about aligning your values and goals. That’s why we developed the Envisioneering® Investment Process - a systematic approach to smarter investing that also pursues aligning your values with your investments.

Investing can be overwhelming. With our three step Envisioneering® process, we keep things as clear as possible for both individuals and businesses to ensure smarter, value driven outcomes. Here’s our process:

What are your goals, and how long do you have to reach them?

We begin by helping you clearly identify your financial goals whether that’s retiring by 60, building generational wealth, or aligning your portfolio with causes you care about. We also explore your timeline by asking these questions:

Our team of financial advisors uses up to five different planning software tools to model your future—far more than most firms—ensuring we tailor our recommendations to your unique circumstances, values, and aspirations.

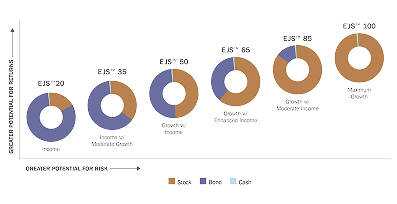

Example of potential pathways:

What are your goals, and how long do you have to reach them?

Once your goals are defined, one of our financial advisors will match you to the most appropriate strategy to meet them. This includes:

Depending on the size of your portfolio and your interests, we can recommend screened ESG funds or customized direct indexing through our Core Justice Series.

What are your goals, and how long do you have to reach them?

This isn’t a “set it and forget it” plan. Our team of financial advisors will regularly monitor your portfolio’s performance against the target return we identified in Step 1. We also track whether your investments still reflect your priorities and evaluate tax efficiency along the way.

Our dedicated advisors adjust your strategy as your life–and the market–evolves.

Whether you've felt underserved by traditional firms or simply want a partner who sees the full picture of your life, we're here to guide you with clarity, integrity, and care.

At Envision Wealth Planning, we listen first, then craft a plan tailored to your life, your values, and your long-term vision. From sustainable portfolios to tax-aware retirement planning, we combine your mission with metrics–ensuring your plan performs well financially and aligns with what matters most to you.

With over 18 years of experience, we’ve developed a unique process—our Envisioneering™ Financial Life Planning approach—and invested in top-tier tools like Advyzon, Morningstar Workstation, MoneyGuideElite, Holistiplan, YourStake, and more. But we don’t just rely on technology. We rely on understanding you.

That's why we've reimagined what values-integrated investing and financial life planning could look like: personal, strategic, and deeply meaningful.

Let’s build the future you envision—one smarter money move at a time.

At Envision Wealth Planning, we serve a diverse community of clients—individuals, families, and business leaders—who are committed to making smart, long-term financial decisions. What they share is a desire for a trusted advisor who combines credentialed expertise with care and clarity.

Whether you're navigating major life transitions or seeking a more values-aligned approach to investing, we offer guidance that’s personalized to your goals, your life, and your legacy. Below are a few of the profiles we most commonly work with.

Professional women often face an income gap compared to men and also have a retirement savings gap. Well-educated and juggling family and career demands, women have unique retirement and wealth realities due to longer life expectancies and responsibilities for caring for parents, children, and partners. Our comprehensive approach considers these realities to help set the right financial course for you.

Retirees face the challenge of ensuring their assets last througout their lifetime. Those receiving a lump-sum retirement plan distribution often need help with a retirement income plan before investing those funds for the long term. Our unique planning process explores what this new stage of life means for you before managing your money. Depending on your risk tolerance, there are income strategies available that may not require investing. If investing is appropriate, we aim to do so in the most tax-efficient and risk-averse manner necessary.

Couples often bring different financial experiences, habits, and timelines into the relationship—especially when there’s an age gap. From navigating retirement readiness at different life stages to balancing income strategies, estate planning, and health care costs, thoughtful coordination becomes essential. Our planning process helps couples clarify shared goals while respecting individual needs, ensuring your plan works for both of you—now and in the years to come. For age-gap couples, we pay close attention to longevity risk, Social Security timing, and legacy planning to protect both partners well into the future. Together, we’ll craft a financial strategy that supports your shared vision with care, clarity, and confidence.

Many investors want to invest in companies that align with their values, such as empowering women and minorities and increasing sustainability. We understand how to incorporate these desires into financial planning. Key areas include investment panning and charitable planning. Business owners may also want to integrate their values into the investment options of their 401(k) or other company retirement plans.

Individuals who acquire wealth through inheritance, divorce, settlement, or lottery often need help managing their new financial situation. Effective tax planning can minimize the erosion of cash. Proper management of these assets, often gained during emotional and difficult periods, can minimize risks like divorce and spendthrift children, which can jeopardize long-term financial goals. We work with clients to enhance their financial literacy and help them understand the risks and trade-offs of their newfound wealth. If you're ready to see if we are a good fit for you, start here.

As a nonprofit or mission-driven leader, your focus is on serving others and advancing the values your organization stands for. Your mission, team, community, and personal goals are often deeply connected—leaving little time to manage the financial complexities behind the scenes. We support you by helping align your retirement plan offerings, organizational finances, and long-term strategy with your mission and values. From customized 403(b) plans to leadership wealth planning, we walk with you to ensure both your organization and the people behind it are financially cared for.

As a business owner, you are fully engaged in the success of your business. Your business, family, community, and individual passions are often intertwined. Consequently, you may have little time to manage your personal resources actively. We assist you in coordinating your cash flow planning, retirement, group benefits planning, tax reduction strategies, estate planning, and long-term wealth planning for both your business and family assets.