Are the investments in your 403(b) plan menu aligned with your organization’s mission? Employees often assume that the investment menu for your 403(b) plan reflects the purpose of your organization. For example, if you are an economic justice nonprofit, does your 403(b) include investments in companies involved in predatory lending?

Unfortunately, mutual funds and exchange-traded funds do not always label themselves in a way that reveals their full impact. If your 403(b) plan includes passive investments, such as those from Vanguard that invest in indexes, it’s important to investigate their alignment. These funds are often selected for their low-cost relative to more active strategies, prioritizing expense over factors such as economic justice, women's empowerment, or environmental sustainability.

Companies like Vanguard simply follow indexes developed by firms such as Standard & Poor's, FTSE, and MSCI. For instance, the Vanguard Retirement 2050 fund holds a variety of index funds. Wouldn’t it make sense to provide investment choices that allow your employees to align their investments with the mission of your nonprofit?

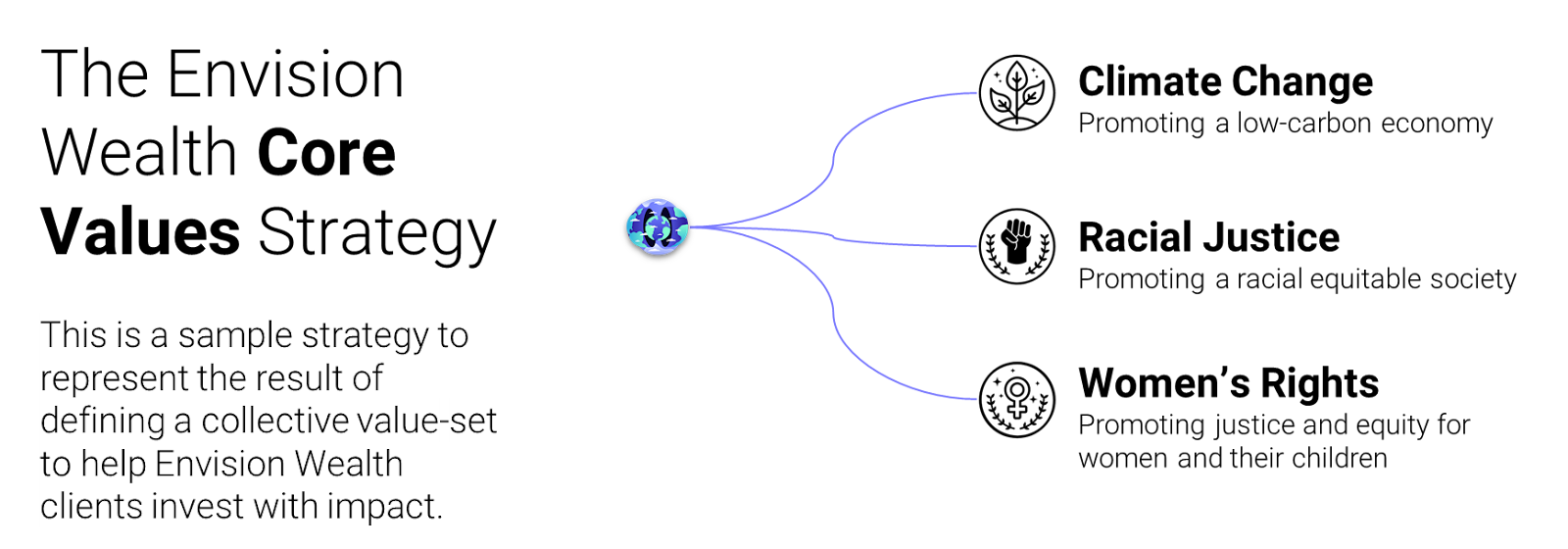

We have found that factors in the Envision Wealth Core Values Strategy, have improved private client returns over the last five years compared to passive strategies.

There’s much to unpack on this assertion. We look forward to learning more about the mission of your organization and exploring how we can incorporate these values into a 403(b) plan investment menu that aligns with your employees' preferences and ensures sound retirement planning.

While not all investments are passive strategies like those offered by Vanguard and iShares, mutual fund companies are required to disclose their investments as of the end of the previous quarter. This information is often available on their websites. One challenge with active investments is that their holdings can change frequently, which might result in temporary misalignment with your mission. Reading their prospectus is one way to understand the potential types of investments they may hold. We also utilize private resources such as YourStake and the Morningstar Sustainability ratings. Additionally, you might want to use the "As You Sow" fund screener to examine your investment menu.

Recently, we collaborated with an economic justice nonprofit that had a Vanguard-only menu. We helped them align their investment menu with the values of their organization, extending beyond economic justice.

Ready to explore how we can help align your 403(b) plan with your organization’s mission?