Envision’s holistic values-based financial planning starts with getting to know your values, passions and goals. In fact, prior to meeting with you, we send you a values assessment. What relationships matter to you? What is your money mindset regarding money, life risks, etc. As you can see your resources and liabilities come later.

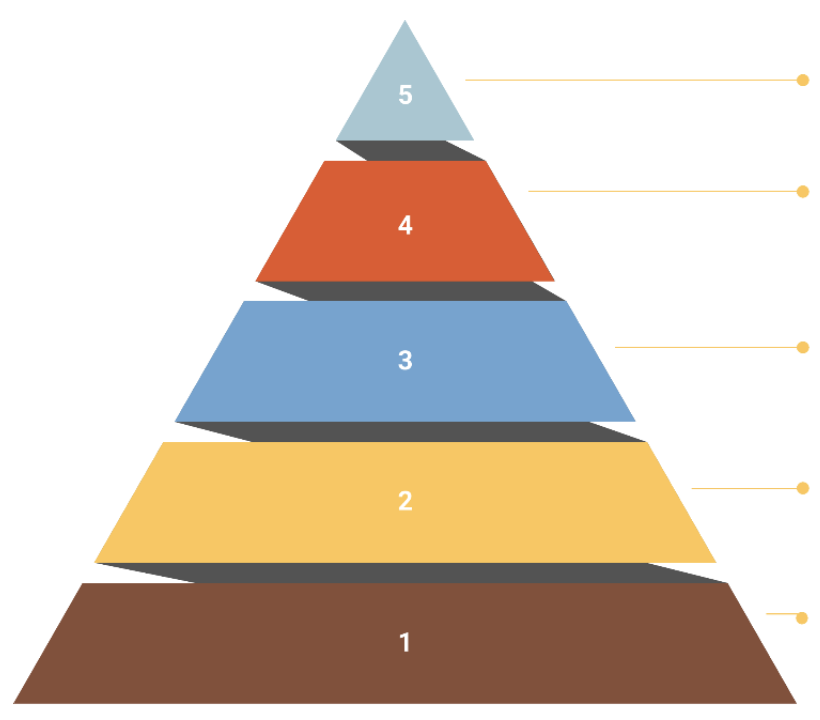

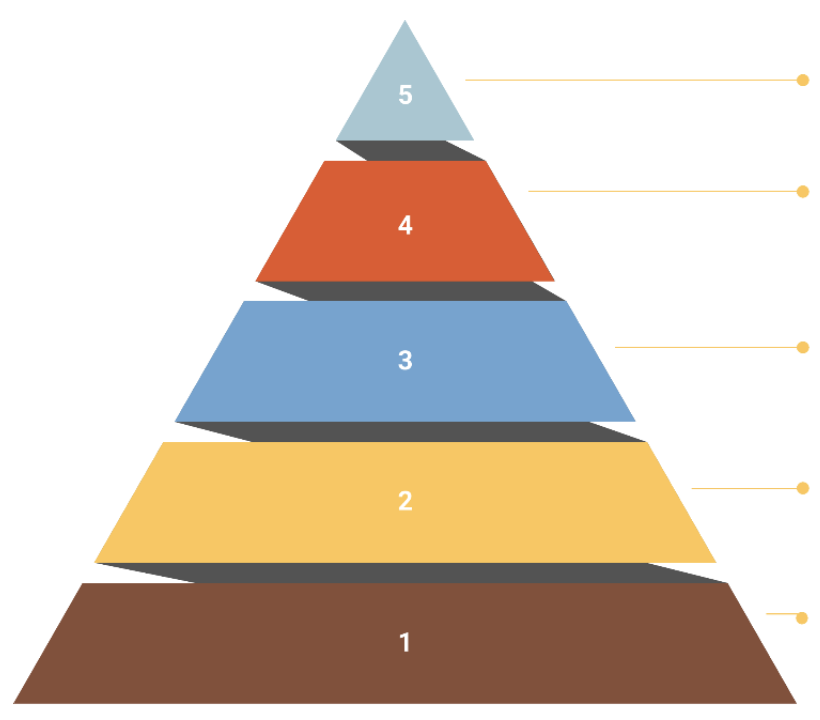

Based on your needs and goals, we develop a custom plan reinforced with a planning pyramid structure that starts with your financial foundation and may include conversations about wealth transfer.

Based on your needs and goals, we develop a custom plan reinforced with a planning pyramid structure that starts with your financial foundation and may include conversations about wealth transfer.

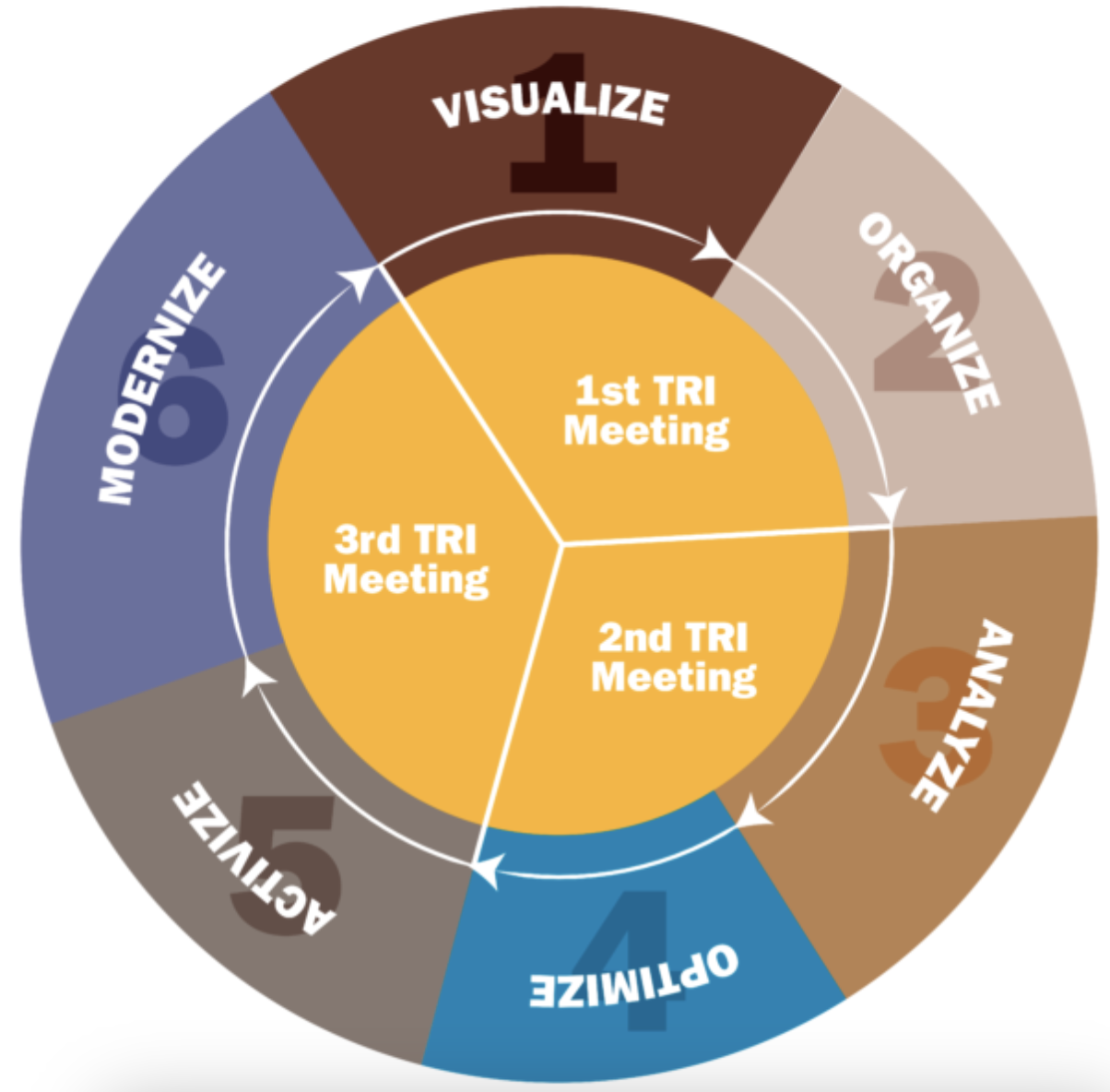

Envisioneering® Financial Life Planning involves 5 initial steps: Visualize, Organize, Analyze, Optimize, and Activize. We begin the process by discussing your priorities, vision, values, passions, and quantify your goals. We’ll discuss your opinions on money and what matters to you. Next, we’ll then Organize your financial information in one place to understand what resources you have to work with. We’ll then Analyze whether you on track to achieve your goals given your current account balances, systematic savings and investment returns. If there is a gap, we’ll give you choices to close the gap. If appropriate, we’ll Optimize your plan through tax, pension and Social Security maximization. Next, you will Activize your plan taking action on saving, student loan payoff, investing, etc.

After the initial meetings, values-based financial planning transitions to trimester meetings. We review your progress on saving for your goals, identify tax planning opportunities, assess your investment return goals, and guide you through employee benefits selections and estate planning issues. We meet you where you need; if circumstances warrant, we will meet to address any financial issues that arise, such as a new job offer. These meetings can either replace one of the scheduled meetings or be billed separately at the same rate.